Introduction to Private Credit

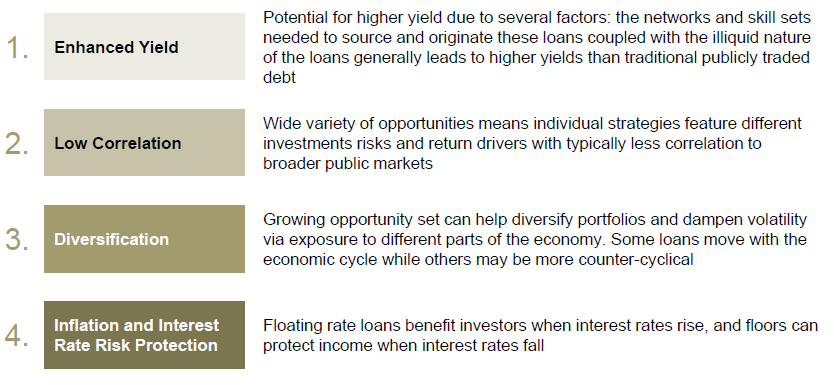

Private credit can complement traditional fixed income strategies by offering enhanced income generation, historically lower volatility, the potential for total return enhancement, and diversification.

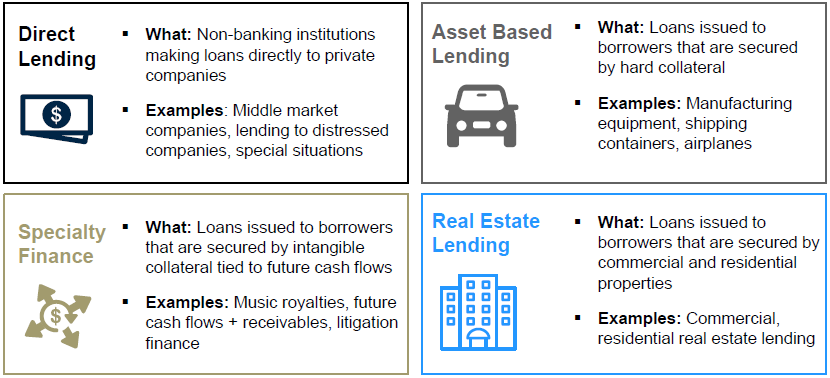

Private Credit refers to loans made to borrowers that are originated outside of the traditional banking system or public fixed income markets.

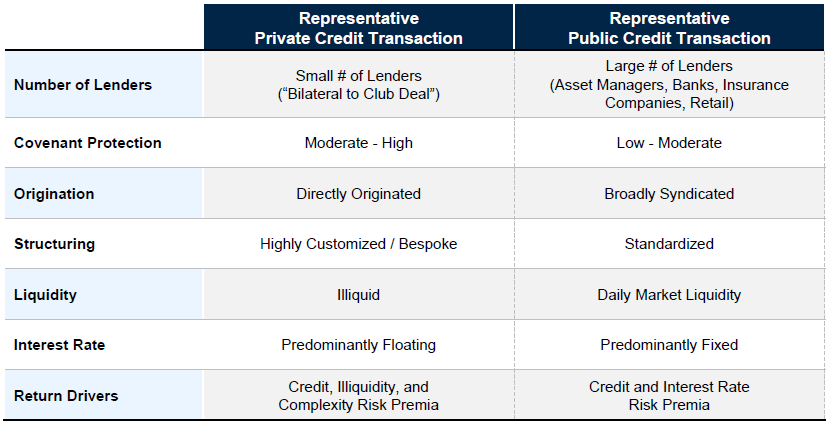

| 1. | These loans are generally floating rate, and do not trade publicly on an exchange |

| 2. | The category covers a wide range of loans in various industries. These loans can be first lien/senior secured loans all the way down to junior debt that is unsecured |

| 3. | Collateral and terms for these loans can vary greatly from loan to loan and are highly customizable based on the borrower’s needs |

The universe of private credit strategies has been expanding and diversifying

Credit refers to much more than one type of bond or investment as it encompasses a spectrum of different categories across the private and public markets

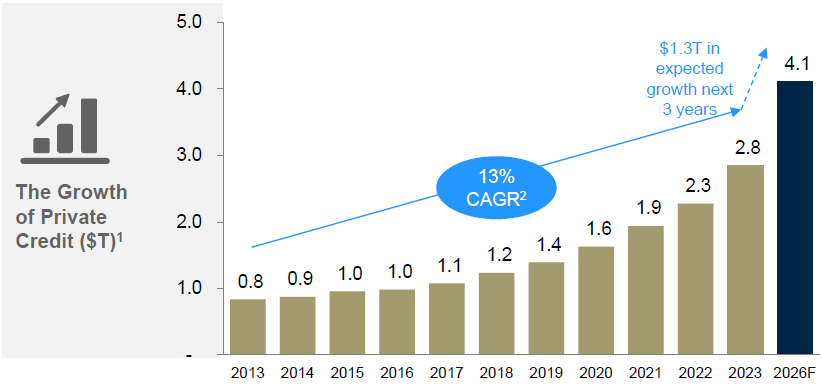

Private credit markets have grown from under $800bn in 2013 to over $2.8tn in 2023, and are expected to continue to expand at a rapid trajectory

2. “CAGR” is defined as Compound Annual Growth Rate | Projected CAGR based on annualized data from H1 2023

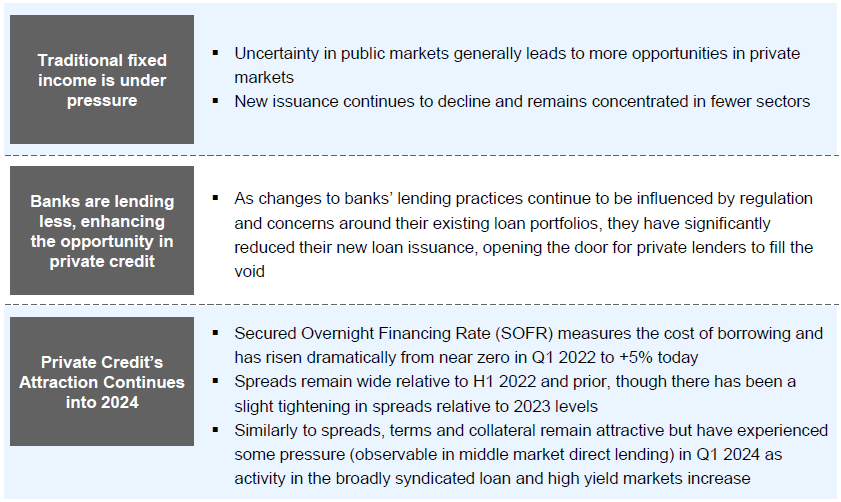

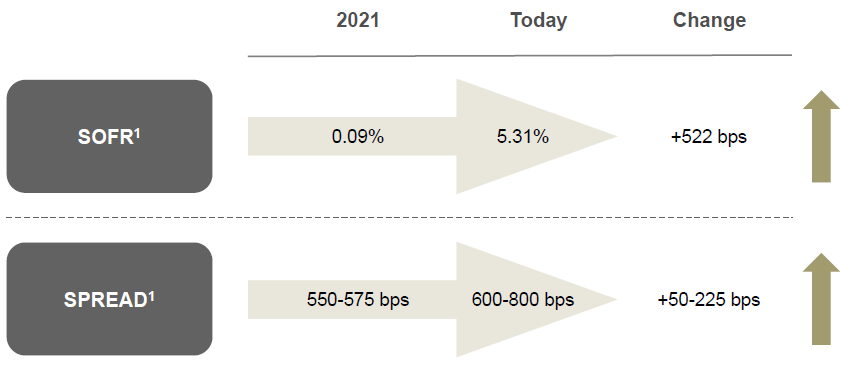

Loan terms, yields, and spreads evolve through a cycle and have significantly improved for lenders in 2023 relative to prior three years, potentially driving returns higher over time

Benefits can include certainty and speed of execution — an attractive feature in volatile public markets – as well as confidentiality in avoidance of broad dissemination of proprietary information

*as of May 2025

Disclosures

for all investors. Prior to making any investment or financial decisions, an investor should seek individualized advice from personal financial, legal, tax and other professionals that consider the particular facts and circumstances of an investor’s own situation. All investments are subject to varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy or product referenced directly or indirectly in this communication will be profitable, perform equally to any corresponding indicated historical performance level(s), or be suitable for your portfolio.

These materials reflect the opinion of NCM on the date of production. Opinions and statements of financial market trends that are based on current market conditions constitute our judgement and are subject to change without notice. Past performance does not guarantee future results. Where data is presented that is prepared by third parties, such information will be cited, and these sources have been deemed to be reliable. However, NCM does not independently verify or otherwise warrant the accuracy of this information. All investments are subject to risks, including the risk of

loss of principal.