Quarterly Market Outlook

Q1 2026

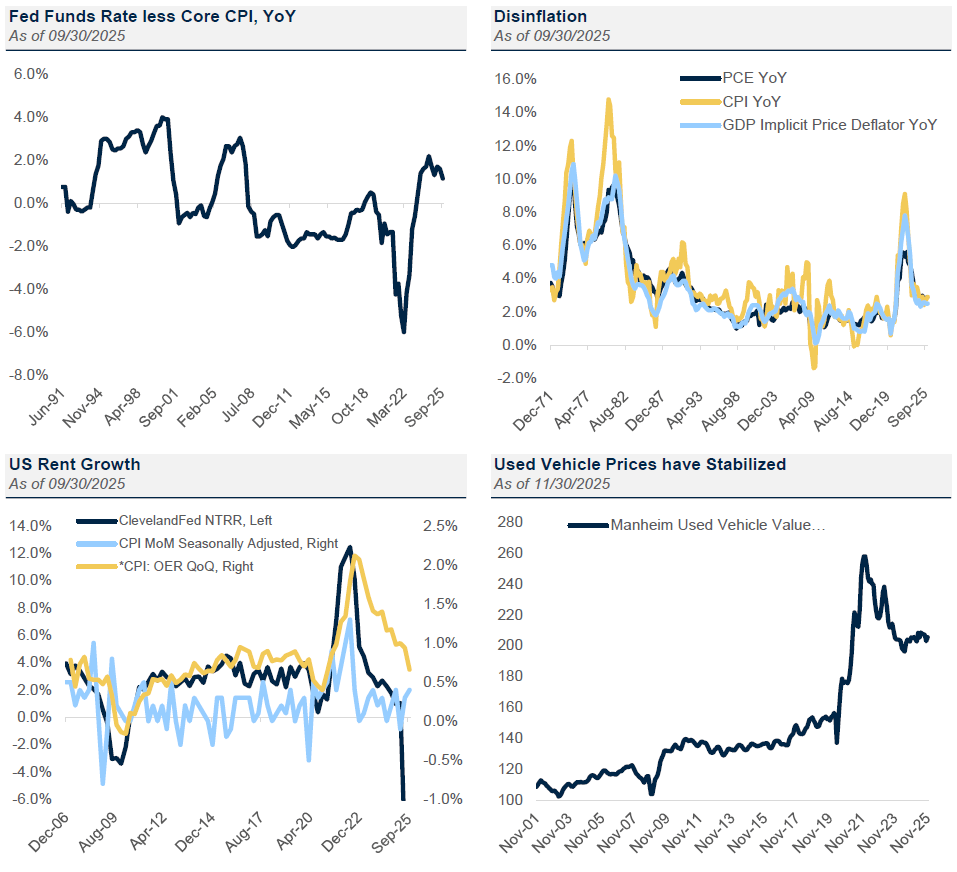

The current macroeconomic backdrop provides a clear picture, albeit with subtle nuances. Recent data and proactive measures taken by the Fed instill a sense of cautious optimism for 2026. The perma-drip of double-piped stimulus—both fiscal and monetary—has been just enough to nourish continued growth and provide a comforting backdrop for investors.

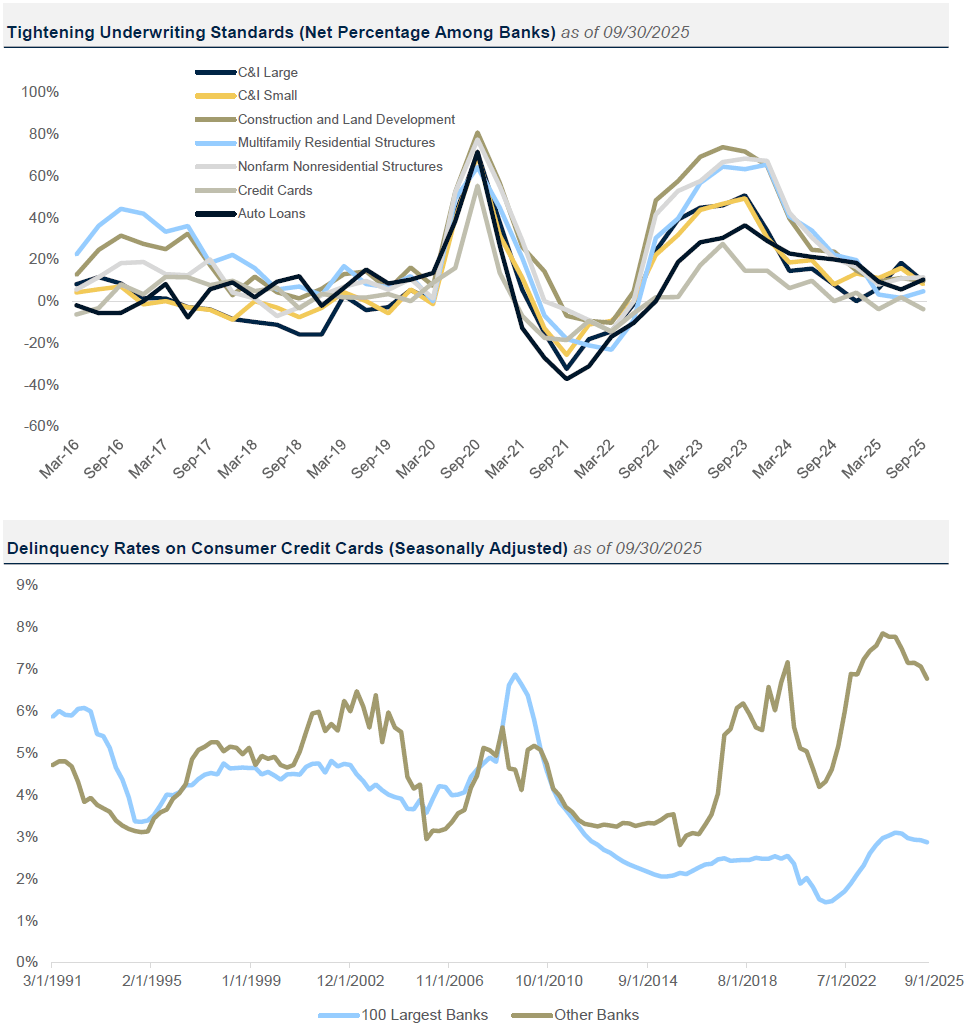

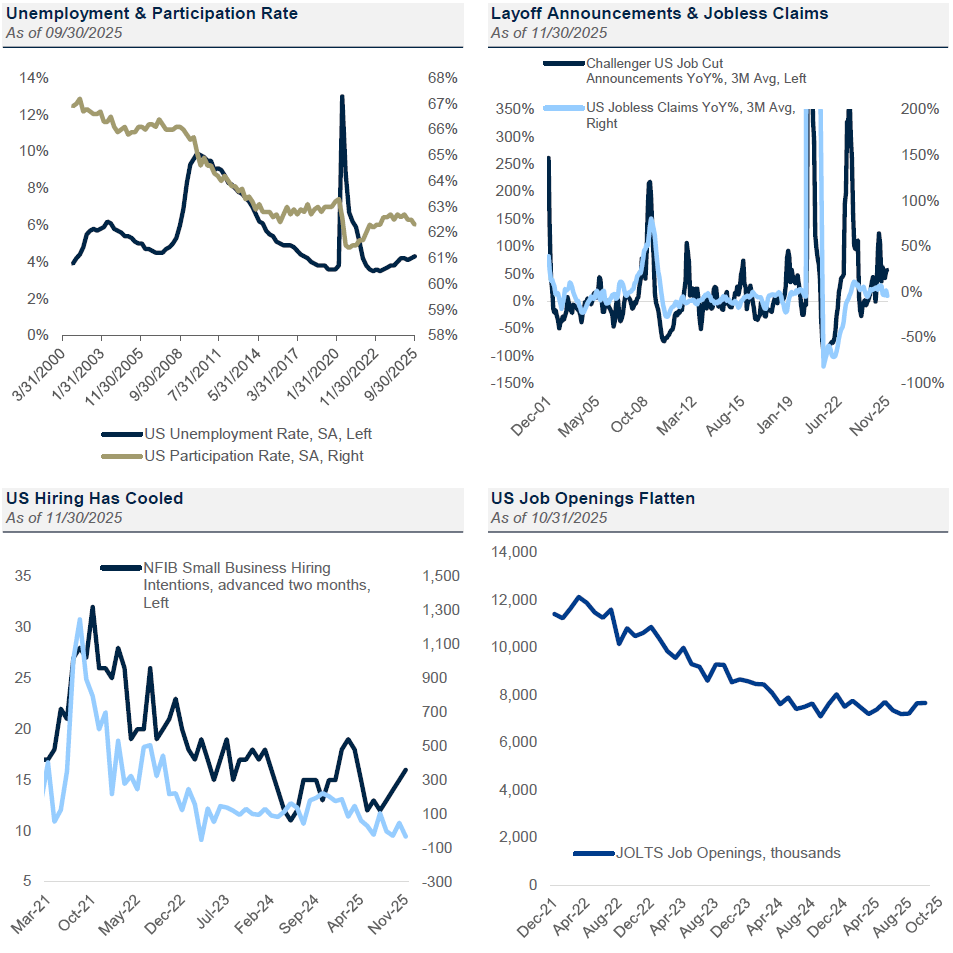

The multiyear effects of the unprecedented COVID-era stimulus—on consumption, savings, delinquencies, and credit—are gracefully returning to a state of normalcy. A few trends may appear discouraging in terms of their trajectory and rate of change, but these shifts are largely reflective of a return to pre-COVID levels. Remarkably, despite the various shocks stemming from policy changes, our economy has shown admirable resilience.

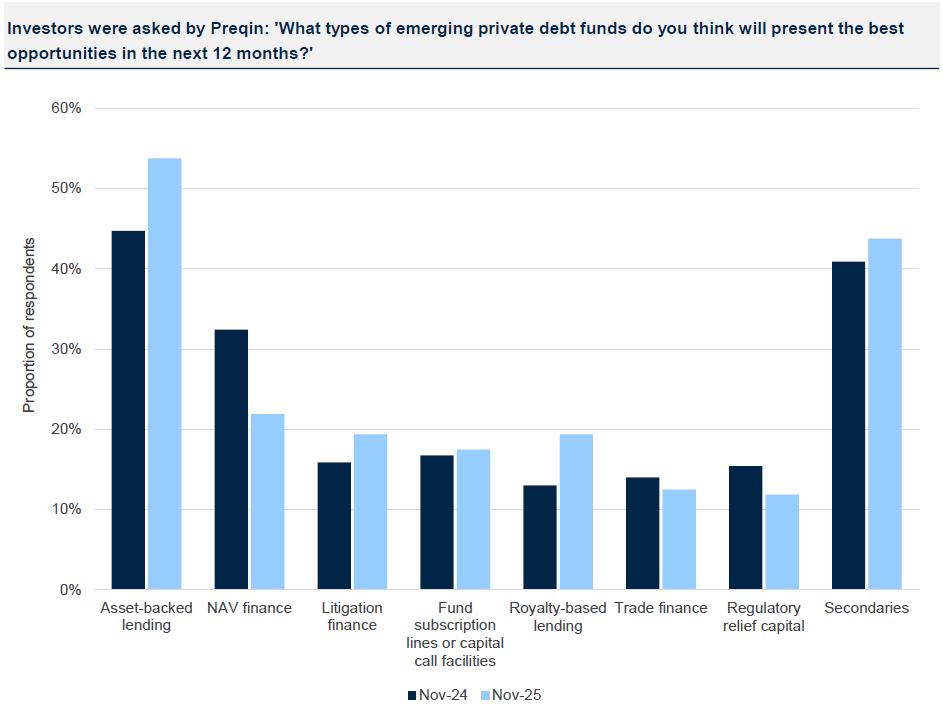

In the evolving landscape of private credit, spreads have continued to compress; however, this phenomenon has decelerated in the last quarter, leaving the credit curve largely unchanged. As market conditions shift, we are witnessing an increase in leverage within capital structures, aimed at enhancing all-in yields amidst declining rates and spreads.

The competitive landscape in private credit is intensifying, particularly with the rise of evergreen vehicles eager to deploy capital consistently and at an accelerated pace. This underscores the imperative to carefully evaluate incremental returns vis-à-vis the additional risks, highlighting the necessity for a more discerning origination process. This shift marks a departure from the recent past, where quality transactions could be sourced at adequate sizes and competitive prices.

In an increasingly crowded milieu, achieving superior returns is best navigated by specialized managers equipped with the requisite depth of experience, robust relationships, and comprehensive origination and workout resources.

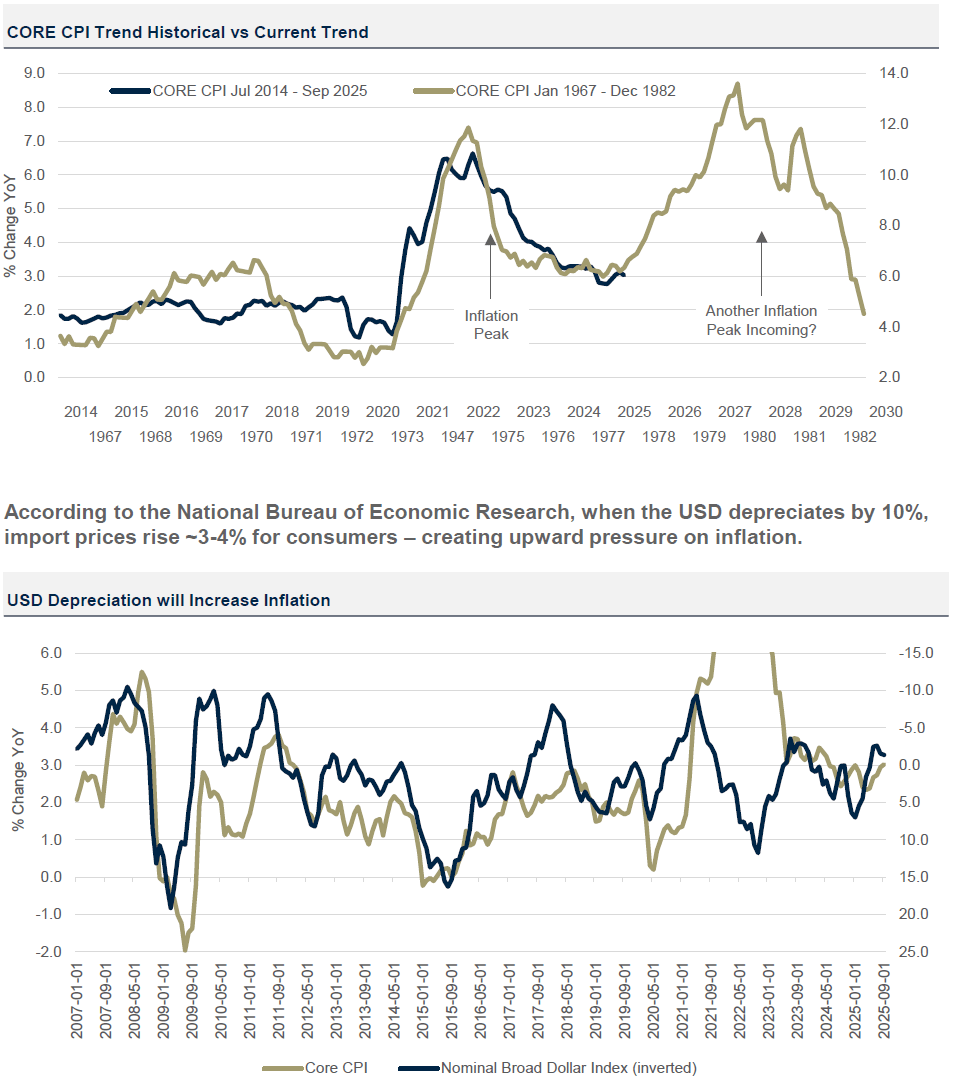

The outlook for real estate is promising, particularly in light of the ongoing benefits from the OBBB. The positive impact of lower interest rates, however, is being partially offset by inflationary pressures that are squeezing consumers’ wallets. As a result, the interplay between these factors warrants careful consideration.

Rental growth rates are beginning to decelerate, a trend that requires vigilant monitoring, especially in regions that have experienced significant supply increases in recent years. The quality of assets and collateral in the real estate sector is also of paramount importance, given the rapid pace of development that may impact future valuations.

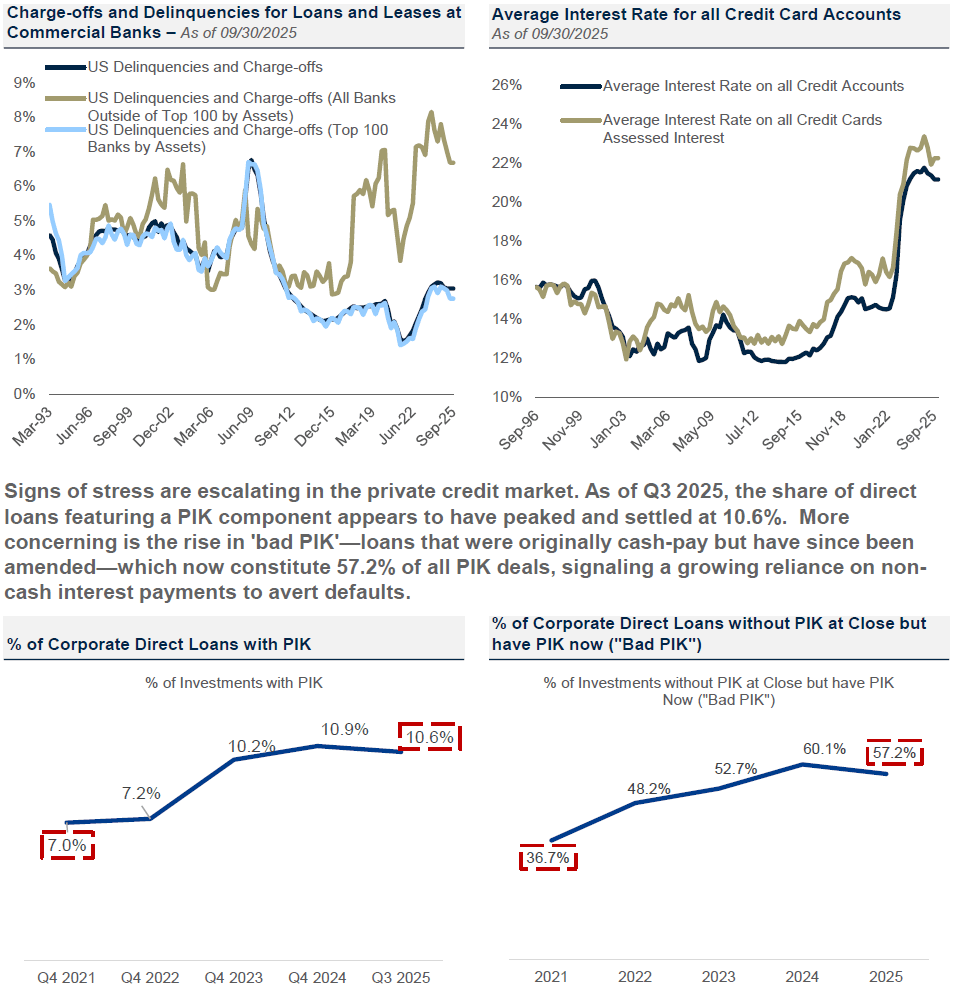

In residential real estate delinquencies have increased, but it is essential to contextualize this rise against the backdrop of the depressed levels seen during the COVID era. Home values continue to exhibit positive year-over-year growth rates, although this trend is beginning to exhibit signs of slowing, with some metrics dipping into negative territory in real terms. Consumers are facing a pullback in credit availability, particularly at the lower end of the socioeconomic spectrum. This situation is compounded by a significant reduction in excess savings and real wage pressures as the labor market shows pockets of softening. Consequently, we maintain a highly selective and cautious approach within consumer asset-based lending, to navigate the evolving landscape effectively.

Within the Corporate Direct Lending space, we are seeing default rates moderating from their recent highs, and the growth of Payment-in-Kind (PIK) transactions not accelerating as rapidly as seen in previous quarters, with activity primarily concentrated in the lower middle market segment. Additionally, the pace of spread tightening in Direct Lending has significantly slowed, and there are even instances of spread widening. This trend appears to be more indicative of declining base rates rather than heightened concerns regarding credit quality.

While the balance of risks suggests that downside scenarios are more probable than average, the considerable stimulus within the system and the government’s expanded toolkit provide a foundation for cautious optimism; thus, we find ourselves marginally more bullish than last quarter. In the realm of private credit, emphasis on diversification, specialized expertise, and an increased array of deal choices is essential as competition intensifies. This asset class offers a compelling source of risk-adjusted income, particularly appealing given current equity valuations at all-time highs, with potential returns making stable, income-yielding products especially attractive.

Corporate Direct Lending

- The Corporate Lending market continues to show signs of stress as evidenced by elevated levels of loans with “Bad PIK” (i.e.., loans that began with cash interest and flipped to PIK). As of Q3-25, ~11% of the market constituted loans with PIK interest. Of this 11%, 57% represented loans with Bad PIK.

- Spreads in the Corporate Lending market tightened in 2025 but have largely remained flat from Q3-25 through November at ~500bps.*

Real Estate Lending

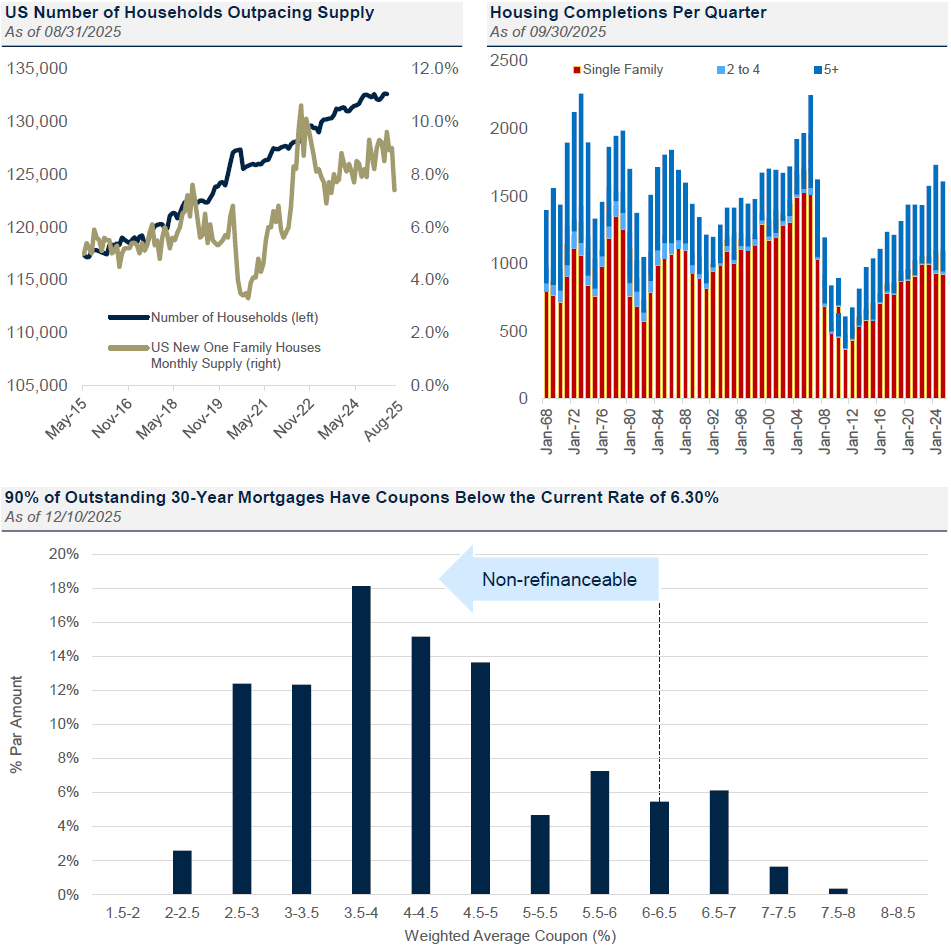

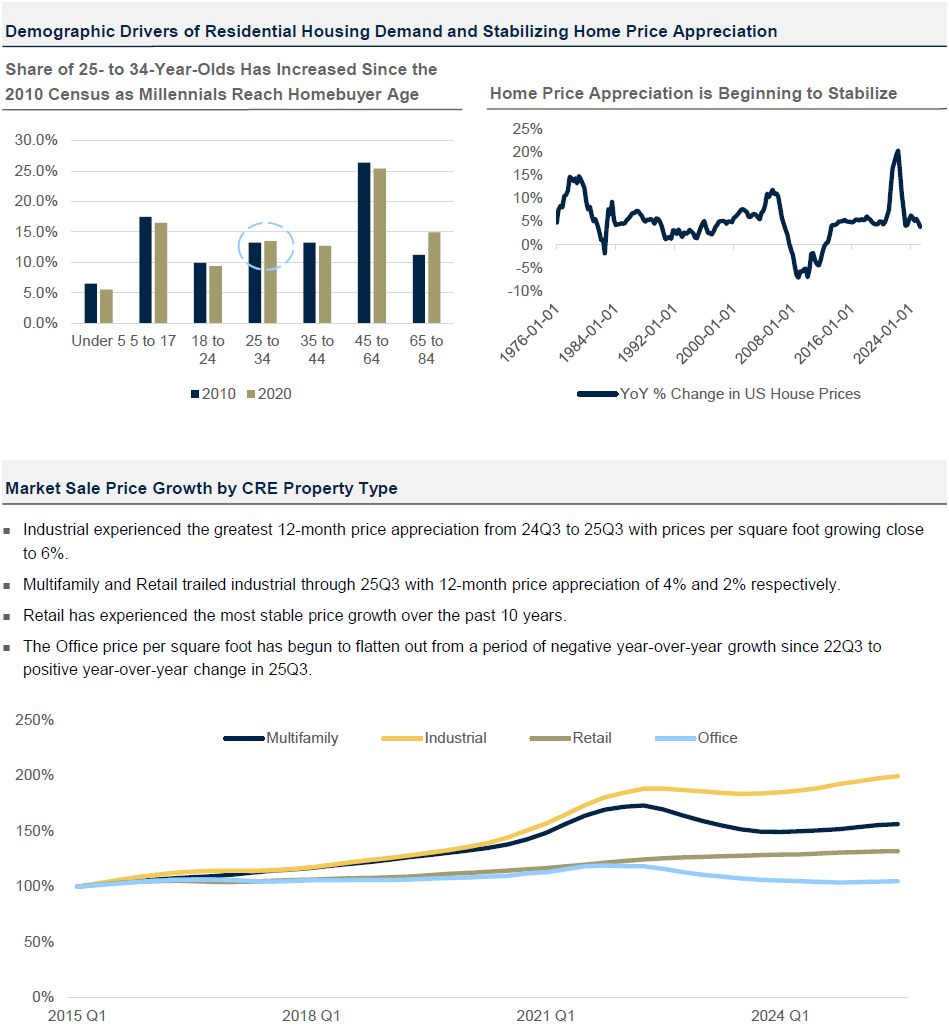

- Millennial demographic tailwinds continue to support robust residential housing demand. While housing inventory has been rising since 2022, it remains below pre-pandemic levels. With Millennials entering peak first-time homebuyer age, demand is likely to stay resilient even as supply slowly normalizes.

- Rates have moved meaningfully lower since Q3 2025 with the Fed reducing policy rates by 50bps. This could improve housing affordability from a borrowing cost perspective and provide incremental support to residential demand.

Asset-Based Consumer Lending

- Subprime auto delinquencies showed signs of peaking but remain at record highs, particularly, in recent vintages where elevated auto prices and borrowing costs have continued to cause stress to lower-income borrowers.

- Student loan deferral expiration has put pressure on FICO trends and consumer credit performance as missed federal payments began to appear on credit reports in early 2025.

* Source: Lincoln International

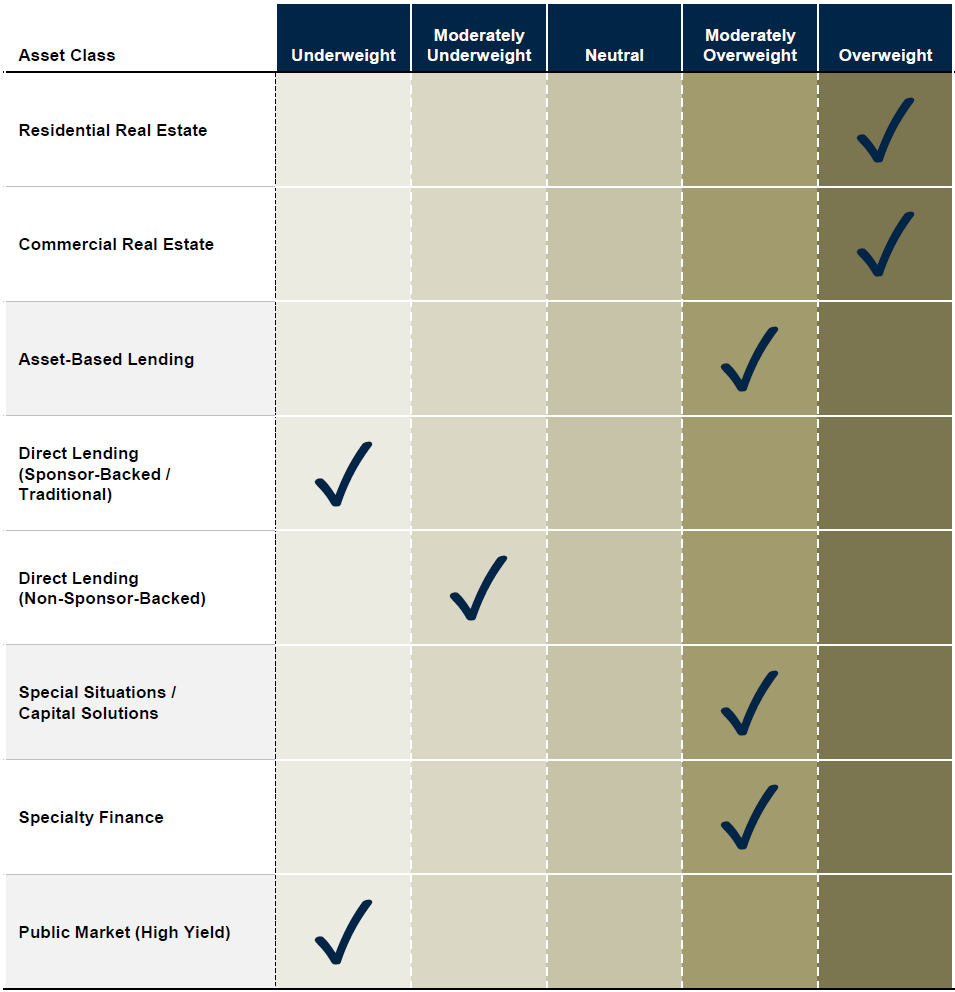

The views expressed in this chart are those of the Investment Team of Nomura Capital Management LLC and are based on the Investment Team’s forward-looking assessment of credit markets as of the date referenced above. The views expressed herein are subject to change at any time following the publication of this report. The arrows in the chart reflect the change in the Investment Team’s outlook of each credit market since its prior quarterly market commentary. This chart is provided for informational purposes only and is not intended to represent a recommendation from Nomura Capital Management LLC to invest in, or divest from, the credit market asset classes referenced herein.

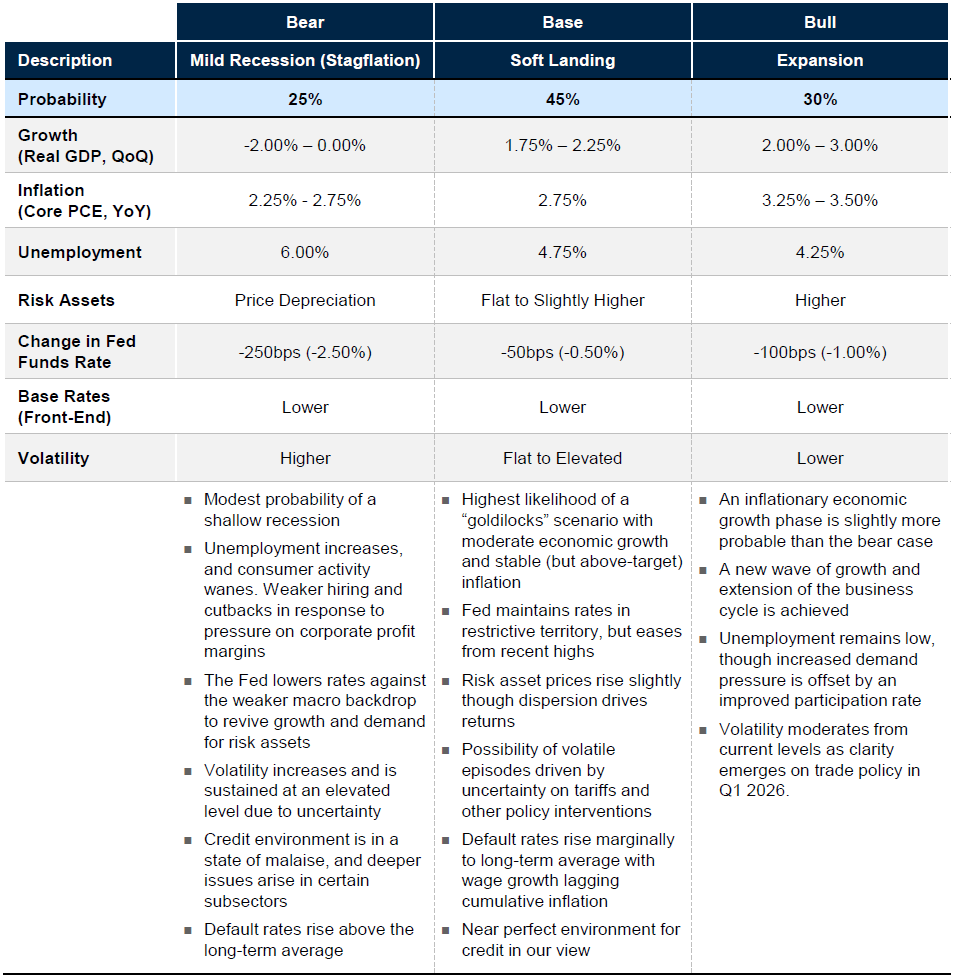

The views expressed in this chart are those of the Investment Team of Nomura Capital Management LLC and are based on the Investment Team’s forward-looking assessment of the general macroeconomic environment as of the date of this report. The Bull/Base/Bear Market (“Market Scenarios”) outcome probabilities noted in this report reflect the Investment Team’s forward-looking estimate of the probability of each Market Scenario occurring within the next 12-18 months from the date of this report. The market metrics noted within this report (Growth, Inflation, Unemployment, Risk Assets, Base Rates and Volatility) represent the Investment Team’s forward-looking estimate of each market metric resulting from the corresponding Market Scenario. All views and estimates contained within this report are as of the date of this report and are subject to change at any time following the publication of this report.

Data sourced from Bloomberg, Federal Reserve Bank of St Louis

Source: U.S. Census Bureau, FRED, Federal Housing Finance Agency, CoStar

Source: Bloomberg, Board of Governors of the Federal Reserve System

C&I Large = Commercial & Industrial Large Energy Users; C&I Small = Commercial & Industrial Small Energy Users

Sources: U.S. Bureau of Labor Statistics via FRED, National Bureau of Economic Research, Apollo

Source: Preqin Investor Surveys, November 2025

Data sourced from Bloomberg

CPI = The Consumer Price Index; PCE = Personal consumption expenditures; Cleveland Fed NTRR = Federal Reserve Bank of Cleveland New Tenants Repeat Rent Index; CPI OER = Consumer Price Index Owners’ Equivalent Rent

CPI is a measure of inflation compiled by the US Bureau of Labor Studies. PCE stands for Personal Consumption Expenditures, which is a measure of how much money US households spend on goods and services. It’s a key indicator of economic growth and inflation.

Data sourced from Bloomberg

Data from Bloomberg, Lincoln International

FOMC: A cautiously optimistic stance amid evolving economic conditions.

Inflation: The Fed’s Core PCE inflation projections have been revised downward to 3.0% for 2025 and 2.5% for 2026, suggesting a belief that inflation pressures may be easing.

Labor market: Hiring and employment are key to demand and growth; labor force size and participation rates are rapidly changing due to lower net immigration and record retirement of baby boomers. Employers are reducing wage gains, job openings are gradually declining, and hiring remains depressed.

Growth: We are marginally more bullish than last quarter; stimulus in the system should support growth.

What we still like:

What we don’t like:

What we are reading:

This is for informational purposes only and is not intended to represent a recommendation from Nomura Capital Management LLC to invest in, or divest from, the credit market asset classes or security types referenced herein.

These materials reflect the opinion of NCM on the date of production. Opinions and statements of financial market trends that are based on current market conditions constitute our judgement and are subject to change without notice. Past performance does not guarantee future results. Where data is presented that is prepared by third parties, such information will be cited, and these sources have been deemed to be reliable. However, NCM does not independently verify or otherwise warrant the accuracy of this information. All investments are subject to risks, including the risk of loss of principal.