Quarterly Market Outlook

As of June 2024 – Unless otherwise stated

Author

Chief Investment Officer

The “soft landing” has been priced by risk markets with low unemployment, disinflation, and moderate GDP growth formulating a strong backdrop for credit investors. As defaults have come down from recent highs and more confidence around the path of rates has emerged, spreads across the range of private credit subsectors have begun to tighten.

Real interest rates remain at elevated levels relative to the last few years, and although this has been digested by risk markets, we are keeping a careful watch on employment, small and medium enterprise (SME) corporate health and the US consumer.

Data coming out of the consumer reflects tighter credit standards, higher cost of borrowing, and a continued trend of higher delinquencies and defaults. At the same time, although the level of unemployment remains low, it is beginning to tick higher and other measures of labor market health are flashing yellow. As excess savings are depleted from post-COVID highs, and both monetary and fiscal stimulus dissipate, concern around the impact of these forces on the consumer are a top watch item.

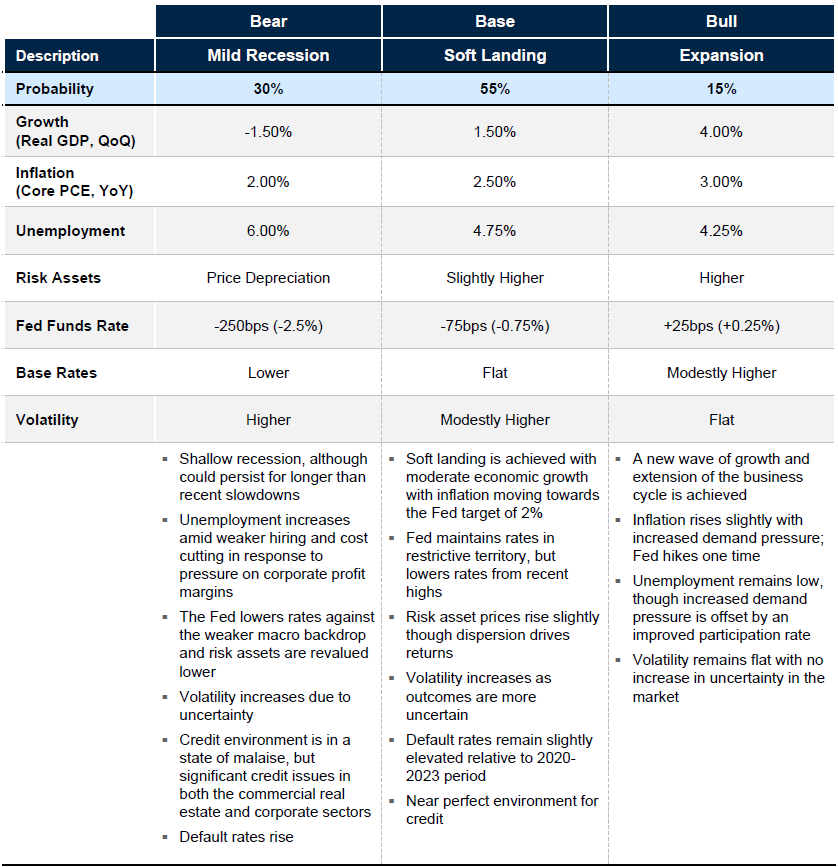

We believe markets are pricing in too much Fed accommodation over the course of the next 12-18 months, and expect no more than three Fed cuts between now and the end of 2025 unless there is a material deterioration in labor market health.

Confidence surrounding the soft landing is warranted, and we continue to see confirmatory high frequency data out of most corners of the macro landscape. Our “Base” case scenario calls for continued growth, tamed inflationary pressure, and a healthy employment environment – yet with moderation in the positive trends we have experienced over the last few quarters. However, given the moderation in constructive factors – where effects are seen within businesses and especially consumers – we see the risks skewed to the downside.

For this reason we see the best strategy warranting extra caution in a few sectors until we have a better read on the situation; these areas are the consumer, commercial real estate (“CRE”), and corporate direct lending. Although we see some opportunities in these sectors, additional care in underwriting and patience will be required for success.

Corporate Credit Landscape

- Sponsor backed direct lending and public credit market spreads continue to grind tighter and issuance activity has remained robust. In comparison, non-sponsored and capital solutions deals have not exhibited as much spread compression.

- Despite tightening in some parts of the corporate credit markets, in our view, income and total return in credit strategies continues to offer double digit return potential while being ahead of equity from a payment priority perspective.

- We have begun to see non-accrual rates of publicly traded business development companies (“BDCs”) increase off a low base.

Real Estate Debt

- CRE transaction volumes continue to be anemic due to rate uncertainty leading to valuation deltas between potential buyers and sellers.

- High quality properties purchased in 2021 may have resetting debt terms over the next 12-24 months, allowing fresh capital to be deployed senior to the equity in order to bridge until properties are stabilized and/or the rates potentially fall.

- We believe residential real estate continues to enjoy high levels of equity value embedded in the properties and tighter underwriting standards.

The State of the Consumer

- Performance amongst lower tier credit borrowers continues to deteriorate.

- Originators are cautiously extending credit to lower credit borrowers after drifting to higher quality borrowers in 2023 as a result of 2022 vintage issues.

- Consumer-related debt must be underwritten to downside scenarios, assuming higher delinquencies and defaults near term.

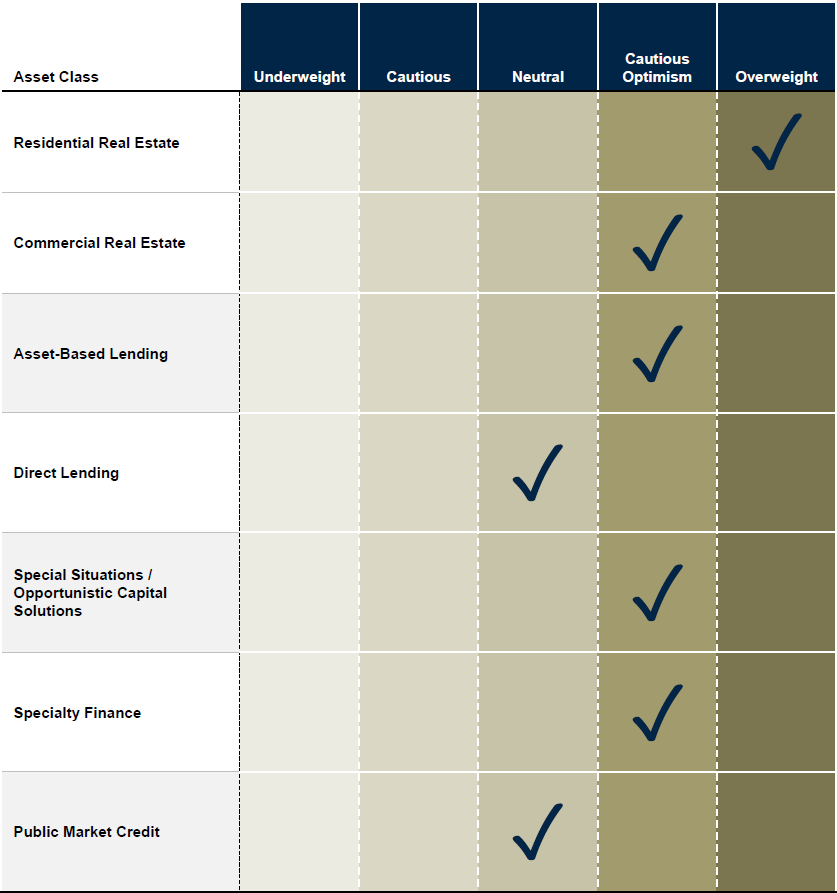

Views on the Credit Markets

The views expressed in this chart are those of the Investment Team of Nomura Capital Management, LLC and are based on the Investment Team’s forward-looking assessment of credit markets as of the date referenced above. The views expressed herein are subject to change at any time following the publication of this report. The arrows in the chart reflect the change in the Investment Team’s outlook of each credit market since its prior quarterly market commentary. This chart is provided for informational purposes only and is not intended to represent a recommendation from Nomura Capital Management, LLC to invest in, or divest from, the credit market asset classes referenced herein.

Economic Outlook (12 –18 Months)

The views expressed in this chart are those of the Investment Team of Nomura Capital Management, LLC and are based on the Investment Team’s forward looking assessment of the general macro economic environment as of the date of this report. The Bull/Base/Bear Market (“Market Scenarios”) outcome probabilities noted in this report reflect the Investment Team’s forward looking estimate of the probability of each Market Scenario occurring within the next 12 18 months from the date of this report. The market metrics noted within this report (Growth, Inflation, Unemployment, Risk Assets, Base Rates and Volatility) represent the Investment Team’s forward looking estimate of each market metric resulting from the corresponding Market Scenario. All views and estimates contained within this report are as of the date of this report and are subject to change at any time following the publication of this report.

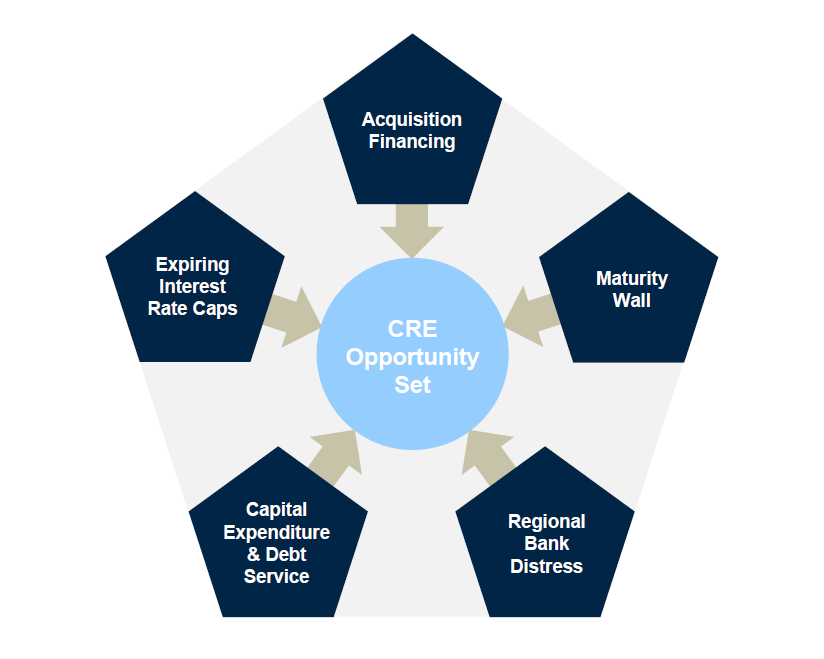

Drivers of Current CRE Opportunity Set

- Acquisition Financing: $260bn of opportunistic CRE equity dry powder, requiring $390bn+ of acquisition financing

- Maturity Wall: $2.6trn of CRE loans maturing within next four years, out of $4.5trn outstanding

- Regional Bank Distress: Banking system margin compression potentially resulting in $347bn of CRE loan sales

- Capital Expenditure & Debt Service: Additional capital injections required by capital intensive businesses creating large opportunity in next 12-24m

- Expiring Interest Rate Caps: floating rate deals starting to burn off, creating liquidity pressure and opportunity catalyst for 2024

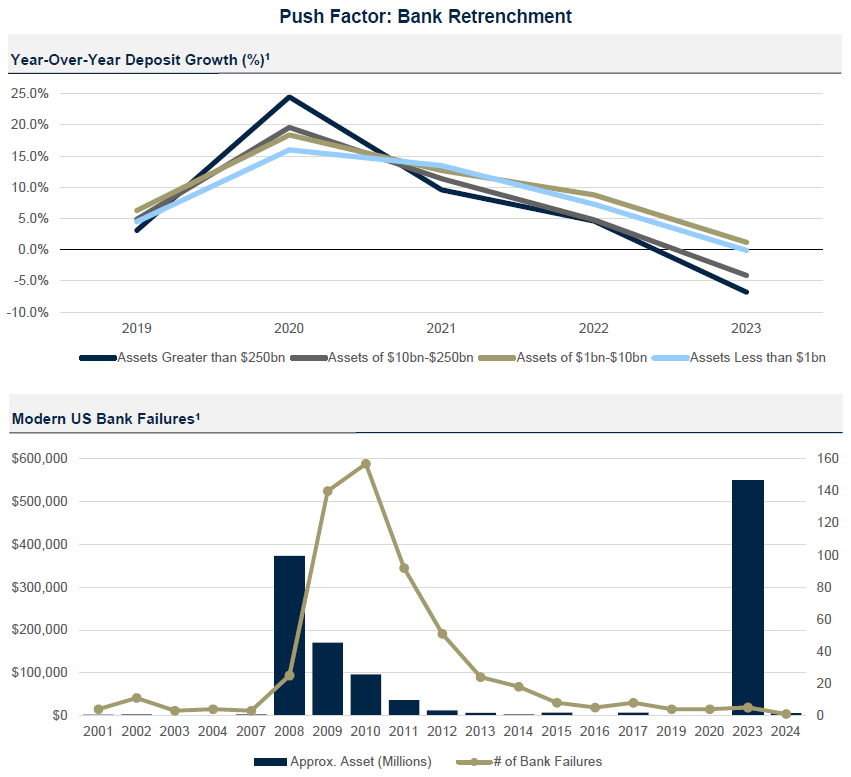

Macroeconomic Environment – Is There Too Much Capital Chasing Private Credit?

NCM believes the answer is no from a combination of push and pull factors.

- There were almost 15k FDIC-insured commercial banks in the 1980s vs. ~4k today while the US economy has grown from GDP of $2.857 trillion in 1980 to $28.26 trillion today.

- Both large and small bank excess deposit growth was meaningfully negative in 2023 and remains flattish to negative in 2024.

- As small banks lose deposit, it will be harder for SMEs to secure loans from the traditional banking sector.

1 Data sourced from the FDIC

Macroeconomic Environment – Is There Too Much Capital Chasing Private Credit?

NCM believes the answer is no from a combination of push and pull factors.

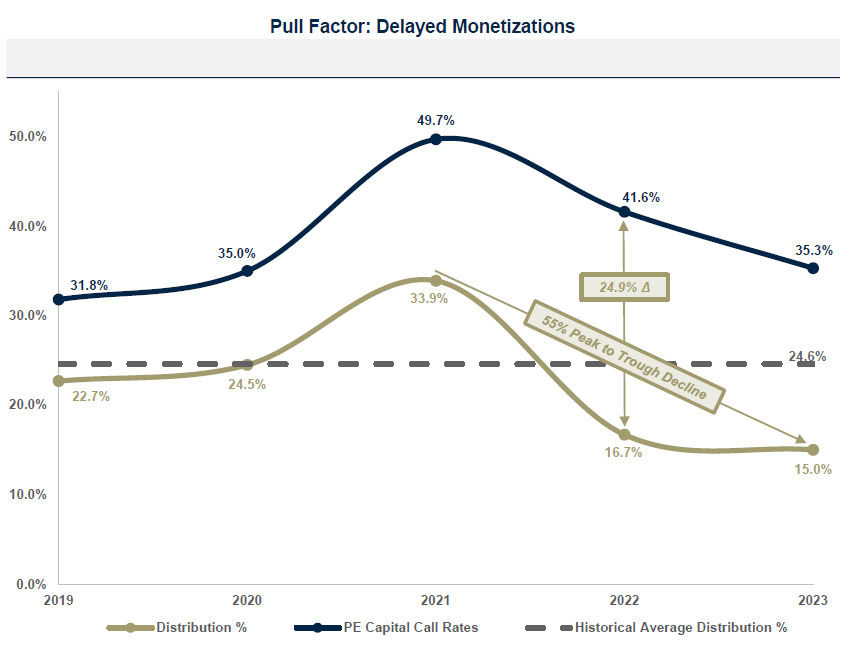

The private equity community has had two years of a lagging distribution rates relative to average, creating the need for credit liquidity solutions such as asset-based lending on existing assets and portfolios to enable private equity (“PE”) owners to return capital to LPs.

1 Data sourced from PitchBook

2 Capital call rate data as of September 30th, 2023 and represents the global private equity market

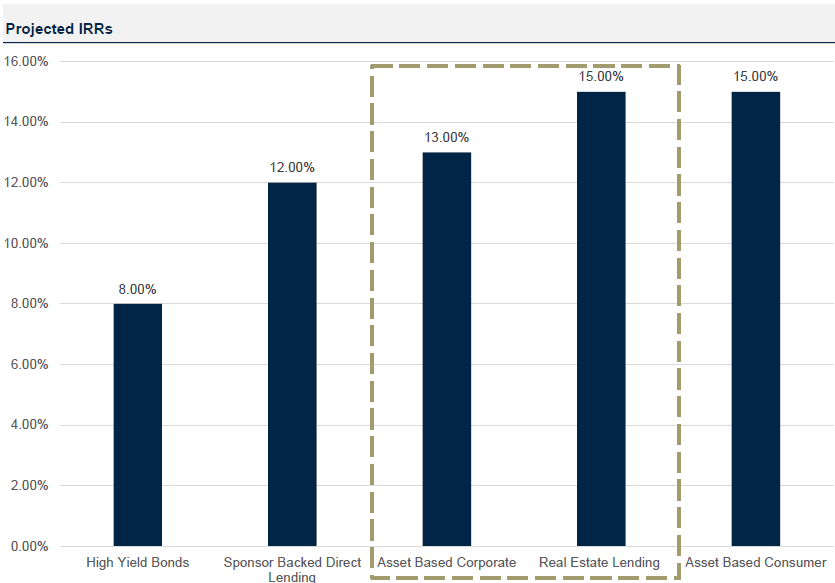

Relative Value Across the Credit Spectrum

We believe private credit markets continue to offer relatively attractive credit opportunities. Opportunities exist as a wave of demand from borrowers is met with regional bank departure from the lending business.

1 Sourced from Nomura Capital Management

2 Dotted line denotes core area of focus for Nomura Capital Management IRR = Internal Rate of Return

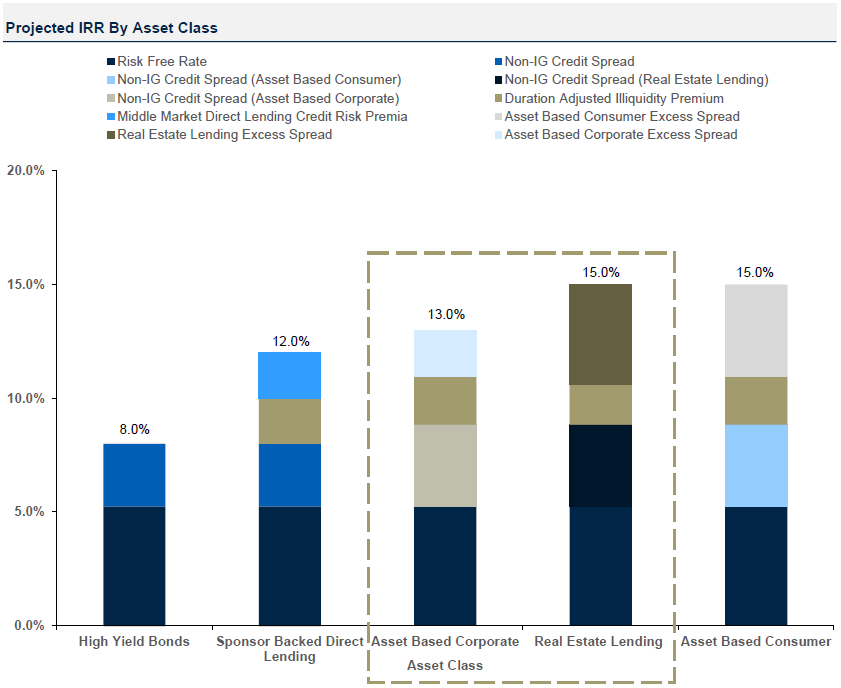

Relative Value Across the Credit Spectrum

Excess yield in private credit is derived from multiple forms of risk premia.

1 Dotted line denotes core area of focus for Nomura Capital Management

2 Data sourced from Morningstar LSTA US Leveraged Loan Index, Private Debt: Yield, Safety and the Emergence of Alternative Lending, by Stephen Nesbitt, Chapter 7, High Yield Bond projected IRRs based on JPM June 26, 2024 JPM US HY YTW (7.84%) and Nomura Capital Management

Non-IG = Non-investment grade bond, considered a low quality investment because the issuer may default

Disclosures

decisions, an investor should seek individualized advice from personal financial, legal, tax and other professionals that consider the particular facts and circumstances of an investor’s own situation All investments are subject to varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy or product referenced directly or indirectly in this communication will be profitable, perform equally to any corresponding indicated historical performance level(s), or be suitable for your portfolio.

These materials reflect the opinion of NCM on the date of production Opinions and statements of financial market trends that are based on current market conditions constitute our judgement and are subject to change without notice Past performance does not guarantee future results Where data is presented that is prepared by third parties, such information will be cited, and these sources have been deemed to be reliable However, NCM does not independently verify or otherwise warrant the accuracy of this information All investments are subject to risks, including the risk of loss of principal